If you’re planning to buy a boat, it’s important to find the right financing option for you. Get a free estimate of your monthly boat loan payment with our easy-to-use free boat loan calculator.

Free Boat Finance Calculator

Our boat finance calculator is straightforward and comes with absolutely no obligations.

WE DON’T EVEN WANT YOUR EMAIL!

There are two ways to use our calculator:

- Monthly Payment: Select “Boat Price” and enter your budget, interest rate, and loan term (length). Our calculator will then provide you with your estimated monthly loan payment.

- Estimate Your Budget: Select “Monthly Budget” and enter your monthly payment, interest rate, and loan term (length). Our calculator will then provide you with the estimated boat prices that could be within your budget (Excluding down payment).

Boat Price

Monthly Budget

| Summary | |

| Boat Budget | $XX,XXX |

| Interest Rate | X% |

| Total Amount | $XX,XXX |

| Summary | |

| Monthly Budget | $X,XXX |

| Interest Rate | X% |

| Total Amount | $XX,XXX |

How Our Loan Calculator Works

Our boat loan payment calculator will guide you on estimating the following:

- How much can you afford to finance

- How much can you borrow

- How the interest rate (APR) will affect your loan

- How the length of the loan will affect your payment and total amount due (term)

How is your boat loan payment calculated?

A boat loan’s monthly payments are typically calculated according to the principal amount of the loan, its interest rate, and how long it will take the borrower to repay it.

Principal: is the total amount one borrows, and the interest rate describes how much it costs to borrow that amount for a certain period of time.

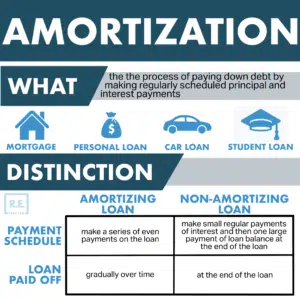

The most common method used to calculate boat loan payments is called the “amortization method.” With this method, the loan is divided into equal payments, with each payment consisting of interest and principal.

Interest: The interest component of the payment is calculated based on the interest rate and the remaining balance of the loan. As the loan is repaid, the balance decreases, and so the amount of interest included in each payment also decreases.

The formula for amortization calculation can be represented as:

Payment = (P* r * (1+r)^n) / ((1+r)^n-1) Where P = Principal r = Interest rate n = Number of payments

The payments you will make in a boat loan will be a combination of the principal and interest paid on each installment. The earlier payments will mostly consist of interest, and as you approach the end of the loan, the payments will be more toward the principal.

Boat Loan Rates Explained

Interest rates are the cost of borrowing money.

They represent the amount that you pay for borrowing someone else’s money and are typically expressed as an annual percentage of the principal or total amount borrowed.

The higher your interest rate, the more it will cost to borrow; conversely, a lower interest rate means your loan will be less expensive.

Getting A Loan With Bad Credit

The minimum credit score to get a boat loan can be as low as 550, however, this can vary based on the following:

- The lender

- If you have collateral

- The total amount financed

That being said, you’re probably very aware that the qualifications for boat financing are more strict than for a car.

An average credit score between 620 and 660 is typically required. If yours is below 620, likely, you would not qualify.

But fear not!

There are lenders who specialize in helping those with poor or no credit history secure financing for their boats. They offer alternative loans, such as seller financing, buy here pay here, and unsecured loans that don’t have collateral as a requirement.

Though these types of loans tend to be more expensive than traditional bank loans, they provide an attractive option for people who otherwise wouldn’t have access to financing due to their bad credit.

Other fees to consider when financing a boat

There are fees to consider when financing a boat. Depending on your lender, you may be responsible for:

- Finance charges: These are the interest and fees charged by the lender. If you take out a loan with an interest rate below prime, it’s likely that your lender will charge a higher-than-prime rate to make up for their loss of revenue from being unable to sell their loan to another party at a lower rate.

- Title fees: These include state or county recording fees and taxes for transferring ownership of property (in this case, your boat). The amount varies by state and is typically paid in addition to any down payment required by the lender for purchase of your vessel.

- Documentation fees: Lenders may require extra documentation before approving loans on boats because they’ve been known not only to depreciate rapidly but also be more difficult than most vehicles when it comes time for resale due upon repayment of said loan(s). This makes them much harder than cars or trucks, so lenders have some extra hoops they need jumped through before issuing financing packages with which they can recoup costs incurred during such endeavors without negatively impacting their bottom lines too much once all things considered

Conclusion

The bottom line is that you need to do your research and find a Marine lender that will work with you. You can use our free boat loan calculator to get an estimate of what your monthly payment would be. Still, for more accurate information, you will have to work with a lender who can evaluate your individual circumstances.